Navigating Event Risks: Insights into the 2024 Election Landscape

Effective preparation involves multifaceted strategies: anticipating potential surprises, having the necessary tools to respond, and, crucially, understanding the risks associated with significant events. The year 2024 is particularly notable for its event risks, from routine earnings reports and inflation figures to the over 50 elections scheduled globally. As risk managers, it’s essential to deploy comprehensive tools to navigate these uncertainties.

Understanding Event Risks and Stock market Volatility

The upcoming US presidential election is a prime example of the inherent unpredictability associated with event risks. The political climate has undergone substantial changes since June:

- Market reactions have fluctuated in response to debates and news about President Biden’s health, with particular focus on ‘Trump Trades’.

- The recent assassination attempt on Trump introduced a new layer of volatility to the market.

- Biden’s withdrawal from the race and his endorsement of Kamala Harris as the Democratic candidate drastically altered the political landscape.

- Harris’s confirmation as the Democratic nominee introduced fresh dynamics to the race, reshaping market expectations.

These shifts underscore the difficulty of predicting Stock market impacts with precision. While betting odds and polling data provide some insights into the prevailing uncertainties surrounding election outcomes, they only offer a partial view of the broader market implications.

Assessing Direct and Indirect Portfolio Exposures

In the realm of investment, diversification is a common strategy for mitigating risk. However, during election cycles, traditional factor models may become less effective. Instead, identifying election-specific factors can be more instructive. For instance:

- A macro futures fund might focus on broader market effects, such as changes in economic indicators and international trade policies influenced by potential election outcomes.

- A cash-equities portfolio might track custom stock baskets that are particularly sensitive to each candidate’s policy proposals. For example, stocks in sectors like healthcare, energy, and technology might experience varied impacts based on the candidates’ stances and proposed regulations.

Leveraging Options Markets and Implied Volatilities

Options markets offer valuable insights into anticipated Stock market movements through implied volatilities. By examining forward implied volatilities, which reflect market expectations for future dates, investors can gain a clearer perspective on potential market fluctuations. For instance:

- During the 2020 US presidential election, the S&P 500 was expected to move by approximately 2.5% based on forward implied volatilities.

- Similarly, forward volatility estimates for currency pairs such as EUR/USD during the same period can help gauge potential shifts in forex markets.

These volatility measures can aid investors in preparing for Stock market changes, helping to anticipate and respond to potential market disruptions more effectively.

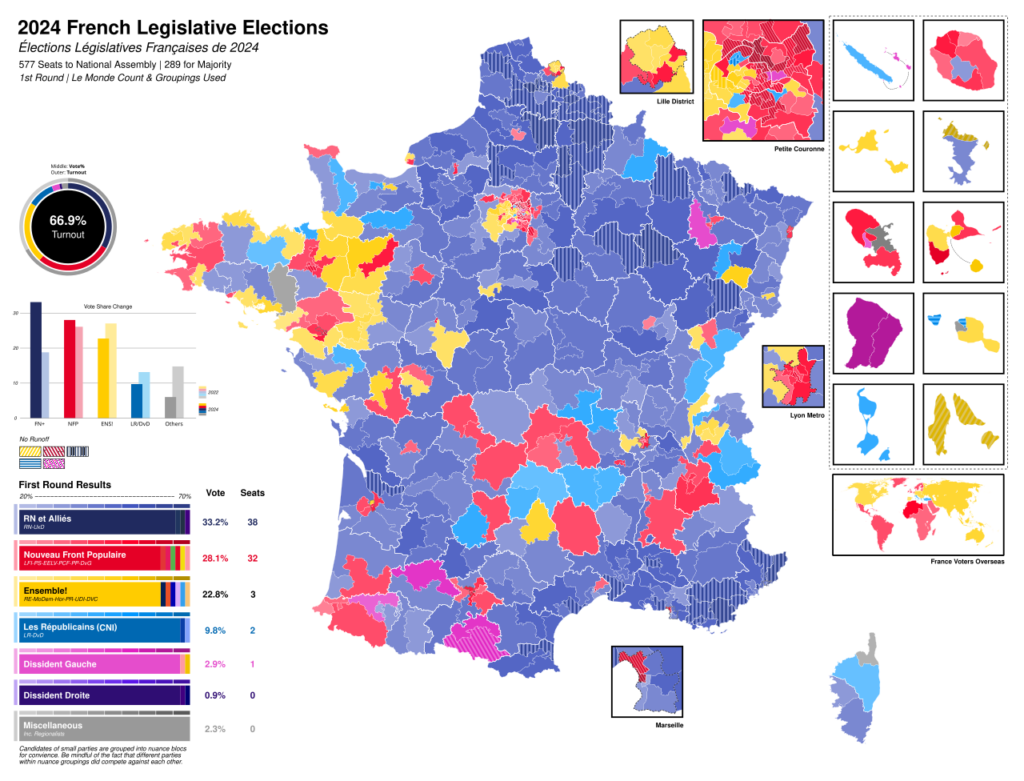

Case Study: The French Legislative Election

The recent French legislative election illustrates the complexities of political forecasting and its impact on financial markets. The unexpected announcement of a snap election by President Macron led to significant market volatility. Key outcomes included:

- A sharp decline in the CAC 40 index, reflecting investor uncertainty and reaction to the sudden electoral shift.

- An increase in European bond yields, indicating heightened Stock market concerns about potential policy changes and economic stability.

The mixed reactions to the election results highlight the importance of preparing for a range of scenarios, from baseline projections to more extreme outcomes. Understanding the potential for Stock market volatility in response to political events is crucial for effective risk management.

Adapting to Changing Electoral Dynamics

As we approach the 2024 elections, investors must consider how evolving electoral dynamics might affect the Stock market. The political race is marked by new candidates, shifting strategies, and evolving voter sentiments, all of which contribute to increased market uncertainty. Historical analysis indicates:

- While elections themselves may have limited long-term effects on overall market performance, specific policy changes and electoral outcomes can have pronounced impacts on different sectors and industries.

- For example, changes in tax policies, trade tariffs, and fiscal stimulus measures can influence sectors such as technology, healthcare, and manufacturing in varied ways, depending on the electoral outcomes and policy directions proposed by the candidates.

Historical Insights and Future Prospects

Historically, financial markets have been more influenced by economic trends and inflationary pressures than by election results. Analysis of past presidential elections reveals that:

- Single-party control of both the presidency and Congress does not consistently lead to market disruptions. Instead, the markets often exhibit resilience and stability.

- Conversely, divided government scenarios, where different parties control the presidency and Congress, tend to result in favorable market returns, potentially due to a more balanced and negotiated approach to policy-making.

For the 2024 election, investors should closely monitor potential policy shifts and their implications for various sectors. Key issues to watch include:

- Tax Policy: Changes in corporate and individual tax rates can impact business profitability and consumer spending.

- Trade Tariffs: Adjustments in trade policies and tariffs can affect international trade dynamics and global supply chains.

- Fiscal Stimulus: Proposals for increased government spending or infrastructure investments can drive economic growth and impact sectors such as construction and technology.

Although historical data provides valuable context, each election cycle presents unique challenges and opportunities. Continuous reassessment and adaptability are essential for navigating the evolving political landscape.

Conclusion: Prioritizing Resilience

Effective preparation involves understanding a broad range of potential outcomes and evaluating portfolio resilience against various disruptions. While it is impossible to predict every change with certainty, integrating thorough analysis with flexibility allows for better risk management. The core of preparedness is not solely in anticipating every possible event but in building a resilient framework capable of withstanding unforeseen shifts.

This expanded analysis offers a comprehensive view of the risks and considerations associated with the 2024 elections and their potential impact on financial markets.

Related Links:

Donald Trump Has 60% Chance of Winning if Election Were Today

3 Reasons Why Bangladesh is Essential to US Interests

Weather Catastrophe! 3 Powerful Reasons the U.S. Tops the Global List

2024 Presidential Race: Kamala Harris Gaining Ground in Key Battleground States

Jerome Powell hints it’s time for a 25-point Fed rate cut

Wall Street: US Stocks Dip 1%, Dollar Rises Before Fed

6 Key Battleground States Poised to Influence US Election Outcome